Wells Fargo

Welcome

Sign on to manage your accounts.

Say hello to convenient checking

Explore our checking options and choose the right account for you

Financial guidance and support

Spend less. Save more. Relax more.

Reduce debt. Build credit. Enjoy life.

Get tools. Get tips. Get peace of mind.

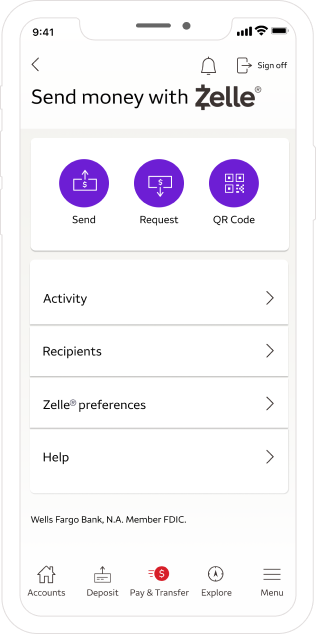

Banking in the palm of your hand

Our Wells Fargo Mobile® app gives you fast and secure access to your finances

Serving our customers and communities

It doesn't happen with one transaction, in one day on the job, or in one quarter. It's earned relationship by relationship.

Who we are